- News

- Reviews

- Bikes

- Accessories

- Accessories - misc

- Computer mounts

- Bags

- Bar ends

- Bike bags & cases

- Bottle cages

- Bottles

- Cameras

- Car racks

- Child seats

- Computers

- Glasses

- GPS units

- Helmets

- Lights - front

- Lights - rear

- Lights - sets

- Locks

- Mirrors

- Mudguards

- Racks

- Pumps & CO2 inflators

- Puncture kits

- Reflectives

- Smart watches

- Stands and racks

- Trailers

- Clothing

- Components

- Bar tape & grips

- Bottom brackets

- Brake & gear cables

- Brake & STI levers

- Brake pads & spares

- Brakes

- Cassettes & freewheels

- Chains

- Chainsets & chainrings

- Derailleurs - front

- Derailleurs - rear

- Forks

- Gear levers & shifters

- Groupsets

- Handlebars & extensions

- Headsets

- Hubs

- Inner tubes

- Pedals

- Quick releases & skewers

- Saddles

- Seatposts

- Stems

- Wheels

- Tyres

- Health, fitness and nutrition

- Tools and workshop

- Miscellaneous

- Buyers Guides

- Features

- Forum

- Recommends

- Podcast

news

Angry Brexiteers contact Dutch bike parts website that stopped shipping to the UK; Nail trap found on popular MTB trail; Beryl Burton mural graffitied; Cycling can improve your chances of employment by 12%; Pro cycling's baby boom + more on the live blog

SUMMARY

Brexit.png

Brexit.png05 January 2021, 17:11

Not so fun fact of the day

The only professional cyclist with all of the letters of 'LOCKDOWN' in their name is Lawson Craddock

— Cillian Kelly (@irishpeloton) January 4, 2021

Sorry for reminding you...

05 January 2021, 16:00

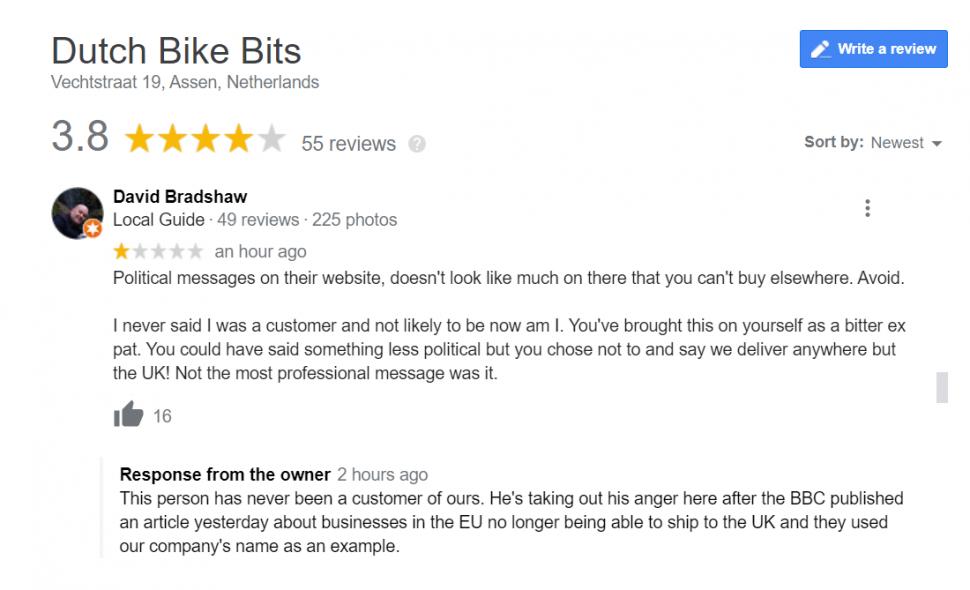

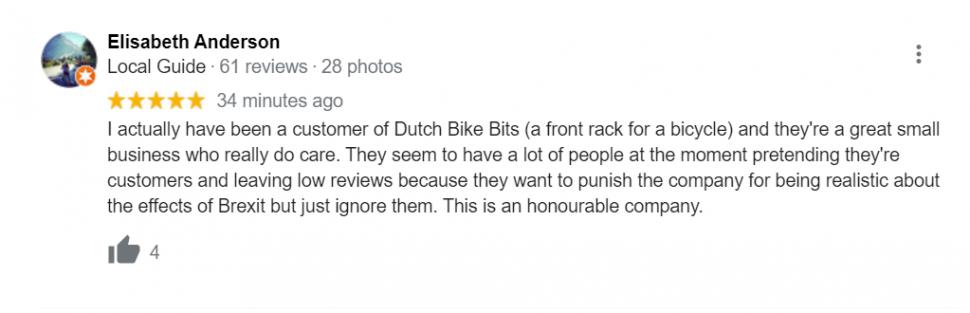

Dutch Bike Bits ask customers for help after Brexiteers target website with negative Google reviews

Brexiteers weren't satisfied with sending angry comments to Dutch Bike Bits...They've also been leaving negative reviews. David Hembrow posted on Twitter: "A BBC article this afternoon used our business as an example of one that is having difficulties sending products to the UK at the moment. This has resulted in lots of non customers placing one star Google reviews to hurt us. Please fix this.

"My real customers are a pretty decent bunch and I really am sad about not being able to deal with them at the moment."

Last week we reported that Dutch Bike Bits were shipping to every country in the world except the UK. Some of the website's real customers have tried to balance the negativity by leaving genuine reviews...

05 January 2021, 16:21

Marc Hirschi leaves Team DSM with immediate effect

Team DSM and @MarcHirschi are to part ways for the 2021 season. Thanks for everything, Marc!

More: https://t.co/ckHtrEaopO pic.twitter.com/t6eLwjw3eq

— Team DSM (@TeamDSM) January 5, 2021

Well, here's some unexpected news for your Tuesday afternoon. Tour de France stage winner Marc Hirschi has left Team DSM, formerly Sunweb, with immediate effect. The Swiss rider became a household name last year following the Tour de France where he claimed three top-three stage results before ending his season on the podium at both Liège–Bastogne–Liège and the World Championships.

A team statement said: "Team DSM has reached a settlement agreement with their rider Marc Hirschi to terminate their present employment before the original end date of 31 December 2021. It has been agreed that the agreement will be terminated with immediate effect and that no further comments will be made.

"Team DSM wishes Marc Hirschi all the best for the continuation of his career and expresses its gratitude for what Marc Hirschi has contributed to the team."

What happens next will be very interesting indeed.

05 January 2021, 17:08

05 January 2021, 15:28

05 January 2021, 15:25

It's an easy mistake to make

It’s a very easy mistake to make. https://t.co/hTTOwXRhOm

— Chris Boardman (@Chris_Boardman) January 5, 2021

Who hasn't gone out to buy potatoes and returned with a new bike? That's a decent upgrade in my books...

05 January 2021, 14:52

How not to park your car

Never successfully in over 10 years of living in this part of town...

— Gus Hoyt (@MrGreenGus) January 5, 2021

So that's three vans and two cars parked in the cycle lane within a single 50-metre stretch of road...

05 January 2021, 13:40

Nail trap found on popular mountain bike trail in Dartmoor

Ryan Best discovered this nail trap on a popular trail for mountain bikers and walkers in Dartmoor over the weekend. The trail from Wotter to Trig Point has been targeted for some time with boulders used to stop cyclists causing Ryan to crash recently. On Saturday, he found nails hidden along the route while out walking his dog and came across a mountain biker with a double puncture having ridden over them. Ryan collected all the nails he could find and told us the incident was particularly concerning as the trail is popular with horse riders and dog walkers — not just cyclists.

Sadly we've seen a rise in the number of these homemade anti-cycling traps over the past few months. A cyclist in Wales found a plank of wood with more than 100 nails, hidden under the soil of a riding trail. While, in May, another Welsh cyclist was injured after piano wire was tied across a path and required treatment at the University Hospital of Wales.

05 January 2021, 12:50

05 January 2021, 12:02

Romain Bardet? Is that really you?

#NouvellePhotoDeProfil pic.twitter.com/CGzqVqXzYw

— Romain Bardet (@romainbardet) January 5, 2021

Having spent all nine years of his professional career with AG2R La Mondiale, it's weird seeing Romain Bardet in anything other than the famous brown shorts. It just doesn't look right to us.

One more day till all those “new year new team” photos. I’m most excited to see @romainbardet in non Ag2r kit. pic.twitter.com/BdvTOuvj0i

— Alex Dowsett (@alexdowsett) December 31, 2020

05 January 2021, 11:47

Another year, another Androni Giocattoli jersey

It's another explosion in a logo factory kit in 2021 for the Italian team run by Gianni Savio. At least they're consistent and as one colleague at road.cc pointed out imagine the psychological toil you'd feel, dehydrated and tired, late in a race having to follow a kit with two water bottles printed on the back. Very clever.

05 January 2021, 10:50

Mentioning you're a cyclist on your CV can help you get a job, new study finds

A new study from GolfSupport found that mentioning that you play a sport on your CV increases your employability by 39% and that 68% of successful candidates at the 200 companies surveyed said they played a sport. 12% of recent hires mentioned that they were cyclists, making it the fourth most successful sport for increasing employability. Applicants who take part in athletics were the most successful, with 20% of recent hires including it on their CV. Tennis and rugby were second and third with 16% and 14% before cycling came next in fourth, ahead of football and boxing.

05 January 2021, 10:22

Pro cycling's lockdown baby boom continues

GEORGES.

que d’amour. 4/01/21 🤍 pic.twitter.com/d0X53OErKh— Wout van Aert (@WoutvanAert) January 5, 2021

Alex Dowsett, Dylan Groenewegen and now Wout van Aert have all welcomed little ones into the world in the past week. Meet Juliette Dowsett, Mayson Groenewgen and Georges van Aert. Some frightening cycling genetics between them.

The early bird catches the worm.

Mayson Groenewegen.

Geboren op 2-1-2021 om 02:17 — 2576 gram

Onze mooie zoon. Wat zijn we gek op jou en wat ben je perfect💙Ondanks een vroeg geboorte van 6 weken doet Mayson het super goed, een gezond sterk kereltje. pic.twitter.com/VEQZq2ySPo

— Dylan Groenewegen (@GroenewegenD) January 2, 2021

Juliette ❤️ pic.twitter.com/0tVcjnykjw

— Alex Dowsett (@alexdowsett) January 4, 2021

05 January 2021, 10:07

Beryl Burton mural graffitied

Mortified to find some talentless moron has defaced our iconic beryl burton mural over the festive holiday. We’re absolutely gutted. @BBCLookNorth @letouryorkshire @yorkshirepost @Welcome2Yorks pic.twitter.com/09msct802C

— woodrup cycles (@woodrupcycles) December 29, 2020

05 January 2021, 08:55

Angry Brexiteers contact Dutch bike parts website that stopped shipping to the UK

The BBC just picked up the story about our not currently shipping to the UK because of the cost of paying tax in that country. Not something a small company can do.

My inbox is now full of incoherent nonsense from brexiter types.https://t.co/BYTCBwgoiGhttps://t.co/pfgd6XwIoy— David Hembrow (@DavidHembrow) January 4, 2021

Over the weekend we reported that cycling advocate David Hembrow's website, Dutch Bike Bits, was now shipping to every country in the world except the UK. Yesterday, it was included in a BBC story about businesses that have stopped shipping to the UK because of a Brexit tax that came into force on January 1. Despite the owner of the bicycle parts website repeating that the change wasn't necessarily a Brexit issue, only that the government couldn't have made the change until after Brexit, his website was flooded with messages from Brexiteers...

One wrote: "I see you have removed the United Kingdom from your list of countries to which you supply. What a spiteful thing to do. I always loved the Dutch country and people but you have ruined the place for me now. We saved your asses during the war and as soon as it gets a bit hard for you, you turn and run. You should be ashamed of yourselves."

Another said it would be "your [the Netherlands] turn next to pull from the corrupt clutches of the EU!" While someone else simply wrote: "Stick your bike bits."

It's turned off now, temporarily.

Before I did so I got a few more idiot replies including something about saving donkeys during the war, a reference to corrupt clutches & one casting aspersions about the BBC Model B. How sad. I enjoyed "Elite".https://t.co/BYTCBwgoiG pic.twitter.com/L0Y8VfesaJ— David Hembrow (@DavidHembrow) January 4, 2021

The changes brought in on January 1 mean that VAT is now calculated at the point of sale rather than the point of importation. Dutch Bike Bits said on its website: "For providing this service, [HMRC] intend to charge a fee to every company in the world in every country in the world which exports to the UK. Clearly this is ludicrous for one country, but imagine if every country in the world had the same idea.

"If every country decided to behave in the same way, then we would have to pay 195 fees every year, keep up with the changes in taxation law for 195 different countries, keep accounts on behalf of 195 different countries and submit payments to 195 tax offices in 195 different countries, and jump through whatever hoops were required to prove that we were doing all of this honestly and without any error."

Dan is the road.cc news editor and has spent the past four years writing stories and features, as well as (hopefully) keeping you entertained on the live blog. Having previously written about nearly every other sport under the sun for the Express, and the weird and wonderful world of non-league football for the Non-League Paper, Dan joined road.cc in 2020. Come the weekend you'll find him labouring up a hill, probably with a mouth full of jelly babies, or making a bonk-induced trip to a south of England petrol station... in search of more jelly babies.

Add new comment

51 comments

EK Spinner

|

3 years ago

4 likes

Re the Nail traps on MTB Trails

"Ryan collected all the nails he could find and told us the incident was particularly concerning as the trail is popular with horse riders and dog walkers — not just cyclists"

This attitude does get to me. I'm sure he doesn't mean it but sounds like it would be less concerning if it were only targeting cyclists - No it F'ing wouldn't

If these don't get investigated and treated seriously then one of these days someone is going to come of and land on these things and get life changing injuries. In fact they don't even have to land on them, just crash because of them.

If and when someone is caught doing this kind of thing they need to have have a long and well publicised prison sentence

To be fair to Ryan, he is probably looking beyond his own experience and social grouping and pointing out the wider effect of this crime, not just how it affects us. The inference that he injury caused by a nail through a horse's hoof or dog's paw is of greater harm than an inconvenient picture also seems pretty fair? His statement both increases the likelihood of getting police commitment to action and shows maturity and concern for others. He did not suggest the behaviour would be acceptable if only cyclists were affected.

wycombewheeler

|

3 years ago

7 likes

The bikebits story is not really a brexit story, this is a UK policy to all online businesses selling into the UK, it is just now applied to EU businesses as well as businesses outside the EU.

Fundamentally this is better for consumers, buying stuff overseas an then having VAT applied at customs causes delay at shipment, and also the royal mail (or other final delivery business) will collect the fee from the consumer, often with a mark up. In addition to goods costing more than is evident at the point of purchase.

My recollection of recieving goods from outside the EU was that a £50 package would be liable for £10 VAT and then royal mail would charge a flat £8 for collecting this tax, whether the VAT was £5 or £200.

If the supplier has 1000 cutomers a year then can charge each £1 to cover the £1000 fee, and the customer will be better off than dealing with the royal mail fees. If they have less than 1000 orders from the UK, then they may reassess whether it is worth their while.

It seems right that businesses selling into the UK via mail, should not have unfair advantages of not paying VAT and so undercutting UK businesses.

I would say strictly as the change or charges did not apply whilst the UK was in the EU and they do now it is a side effect of brexit ? The effect expressed as a benefit or negative upon the supplier and consumer is a different discussion. It will be for each company to choose the advantage to them as against the cost and your example is fair that the projected cost will need to be balanced against each potential purchase. It is not so much the charge of VAT as the rates were standardised within the EU as the additional administration and time that each company will now have to incorporate which will hit smaller companies more than larger companies and risks eroding consumer choice ?

Yes there is admin, but surely the cost of that is not the £8 per order that the royal mail were taking from customers in order to recieve their delivery. An inefficient charging system caused partialy by th mail covering themselves against non payment.

Sell to UK customers pay UK VAT, seems fairly simple to me. Don't want to pay UK VAT, then don't. bikebits is at liberty to make that decision, based on an assessment of their current business volumes.

Potentially there may be a small reduction in choice, or we may see more choice within the UK. But there will certainly be an increase in clarity with customers no longer recieving deliveries with unexpected bills.

It's a balance between placing the admin burden on the customer versus on the seller. Obviously paying tax + fees at the point of import is an inconvenience, but for some customers that inconvenience is worth it if it means getting a particular item. I suspect there's quite a lot of companies (especially American companies with a large domestic customer base and few UK customers) that won't bother jumping through the extra hoops and that will just reduce options for customers.

I don't see why there couldn't be a two-tier system. Companies that do a lot of business with the UK can register for VAT and pay it at the point of sale in order to provide their customers with a seamless experience. Non-registered companies are still allowed to send goods untaxed and require the customer to pay the taxes upon import.

Maybe more could be done to educate customers about the taxes and fees so they are not "unexpected" but I don't see an inherent problem with that system.

I've always been a bit confused by Brexit arguments as they seem to to want to cherry pick which bits of a free market economy / neo-liberalism suit them best.

However, making it harder to buy from non-UK companies and protecting British business is surely what "some" Brexiteers wanted.

I've never fully accepted the argument though. I prefer/choose to purchase from UK based companies that pay the requisit taxes to HMRC and employ people based in the UK. If all 17m Brexit voters did the same I think our economy would be much better for it.

Another alternative for a small business is to simply set up a UK serving shop on eBay/Etsy/Amazon Marketplace etc.

Increase the prices slightly to compensate for whatever fee the platform charges and all the VAT will be managed by said platform.

Minimal investment required if you already have an online business.

This IS a Brexit story. If the UK was still within the EU / single market these changes would not have occured. I take your point on the fairness of collecting taxes etc. but trade within the EU is streamlined by the fact that for the consumer all taxes have already been included (and paid). Different story outside the EU and that hasn't changed.

The way I would like to see it (neglecting just getting rid of VAT as inherently regressive) is that consumers can open an online acccount with HMRC. When they order something online they register the future delivery and make sure there is enough money in their account to cover the taxes and then everything is checked electronically and mail just flows through.

Retailers could take advantage of an HMRC API to do the form filling out for you and if you already had your credit card linked with HMRC then you woudln't need to even do anything yourself.

Sriracha

|

3 years ago

5 likes

I'm still trying to work out whether the BBC was deliberately trying to put Dutch Bike Bits across as just another EU business caught in the brexit crossfire, or whether they were plain negligent.

Dutch Bike Bits is David Hembrow, a UK expat to the EU, with longstanding strong anti-brexit, pro-EU views. Nothing wrong with that. But for the BBC to platform his views as if it were just another foreign firm caught up in the Brexit cross fire is either disingenuous or naive.

http://davidhembrow.blogspot.com/2016/06/brexit-my-country-was-taken-fro...

all EU member states will have the same rules from July, it should have been implemented EU wide on January 1st, as with the UKs change,and ironically perhaps as it was originally an EU led policy, the UK has simply adopted it for them first. But the EU delayed their change to give all its remaining member states more time to make the changes, due to the efforts focussed on dealing with Covid currently.

https://ec.europa.eu/taxation_customs/business/vat/modernising-vat-cross...

all EU member states will have the same rules from July

Only for shipments into the EU from non-EU countries (mainly to close a VAT loophole for low value goods).

Within the EU, VAT collection is going to get easier. They are removing the limits that require member state registration and introducing a 'One Stop Shop', whereby all VAT is paid in a single state.

https://ec.europa.eu/taxation_customs/sites/taxation/files/vat-e-commerc...

migrant, not expat.

(sorry, as a migrant, it's a pet bugbear of mine - the way people refer to UK citizens living in the EU as 'expats', whereas EU citizens living in the UK are 'migrants'. It stops there being a sensible debate about migration and freedom of movement.)

Ah, well, does the GDPR apply to data subjects outside the EU?

I don't think it matters where the individual is located, but obviously a company operating outside of the EU (and not processing any EU data) won't have to comply. Companies operating in the EU have to abide by GDPR for all individuals.

I am not a data reg lawyer but my understanding is that the GDPR applies to EU citizens (regardless of their geographic location of the company or theoretically the resident). Now I don't know what has been agreed on data protection in the trade deal - unless it is covered by the arrangements then hte GDPR would not apply as the data does not relate to EU citizens so should be in the clear.

I am not a data reg lawyer but my understanding is that the GDPR applies to EU citizens (regardless of their geographic location of the company or theoretically the resident). Now I don't know what has been agreed on data protection in the trade deal - unless it is covered by the arrangements then hte GDPR would not apply as the data does not relate to EU citizens so should be in the clear.

My understanding is that the opposite applies. Companies operating in the EU have to be careful with processing personal information of any person, whereas companies outside of the EU won't have to comply even if the individual is an EU citizen (the EU law wouldn't have jurisdiction, so it's irrelevant where the individual was born). It's more complicated when EU data is passed across to non-EU companies and the brunt of compliance is on the EU companies sending that data across borders.

External-EU companies agree to comply otherwise they can't do business. Yes if they breach it then the fines might not be enforceable but I suspect it depends on the company setup. After all the EU had the clout about IE being enforced in Windows bck in the day and other changes in Tech.

You are correct that it is up to the EU company when dealing with externals but normally it consists of "Where do you store our data and does it comply with GDPR or Safe Harbour?" (or whatever the new equivalent is) "The answer is no! Sorry we have to go elsewhere with our business". Hence why most of them comply to it.

Pages

Latest Comments

- Geordiepeddeler 10 sec ago

Cycling infrastructure does not force drivers to break the law, drivers are the reason they break the law, no one else.

- chrisonabike 12 min 44 sec ago

Ah but taking pictures of things to defy the man (avoid a fine) is righteous. Taking pictures of people to grass on them to the cops (perhaps...

- ktache 2 hours 2 min ago

But getting paid for it is the very definition of professional....

- ktache 2 hours 11 min ago

Never had a Shimano QR fail on me. They just work. And the top end ones look good too....

- Backladder 2 hours 57 min ago

If you're only looking at the guy in front of you then you're going to crash whatever brakes you have, you need to look beyond them to anticipate...

- jaysa 3 hours 23 min ago

As a woman, this works great for me! My chain broke once, and a kind guy stopped with a chain breaker and sorted it all out for me. We stopped at a...

- andystow 4 hours 14 min ago

Same. I also have gone through a bunch of their tyres, and only the extralight disappointed (torn sidewall) but the standards are fantastic....

- chrisonabike 6 hours 11 min ago

Indeed - but it's no more inconsistent than our current road design - very often UK high streets are "for shopping" and also a busy through route....

- mike the bike 7 hours 42 min ago

If you ask the world's leading economic commentators how many people have been rescued from abject poverty by capitalism the average answer would...